The tools for your future are here

Okanagan College offers the newest equipment and technologies in state-of-the-art training facilities located in Kelowna, Vernon, Salmon Arm, and Penticton. Students master skills taught by industry-leading instructors while gaining hands-on experience. Learn in small classes, in more than 20 different programs that have provincial, national and international recognition. Whether you are seeking Red Seal certification or one-time specialty industry training, education at OC sets you up for a successful career.

Apply now

Already know which program you want to apply for? Skip straight to the application process now!

| Entry-level Foundation Program *To explore our programs and schedules, see below. Training Schedules and availability for each program are included under each individual program page. | Apprenticeship Program *apprenticeship programs are designed for registered apprentices who are already working in the industry. |

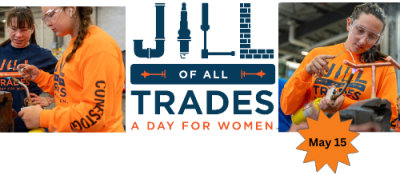

Jill of All Trades™ is a day-long event to inspire young women in Grades 9-12 to pursue education and careers in skilled trades and apprenticeship. Jill of All Trades™ has been a tremendous success internationally. The event includes many hands-on workshops in the motive power, manufacturing, and construction trades sectors. Female mentors lead these workshops to help young women develop a better understanding of the potential of skilled trades’ careers.

Okanagan College will be hosting 120 young women and mentors on May 15 2024.

Awards and Bursaries

Canerector Trades Awards

Apply by September 15 for Summer/Fall 2024. Domestic students with confirmed seats in Construction, Manufacturing, Aerospace and Manufacturing Trades Foundation or Diploma classes are eligible to apply.

Highstreet Entrance Bursaries for Foundation Level Construction Trades

Thirteen (13) entrance bursaries are available – valued at $6,500 each!

Up to 4 bursaries are High School Entrance, designated for those who have graduated from a BC Secondary school in the last 18 months.

Students must be entering a construction trade: Carpenter, Carpenter-Joiner, Electrician, Plumbing & Piping, Refrigeration & AC Mechanic, Sheet Metal Worker, or Welder Foundation/ Pre-Apprenticeship.

Applications for the Highstreet Entrance Bursary are open:

- Fall 2024 High School Entrance Awards – Dec. 1, 2023 to March 8, 2024

- Fall Entrance Awards – July 1 to September 15, 2024

- Winter Entrance Awards – December 1, 2024 to February 15

- Summer Entrance Awards - March 1 to May 31

Foundation vs apprenticeship: what's the difference?

Foundation programs are entry-level training programs for people with little or no experience in the field. Apprenticeships are for people working in the trade for an employer who sponsors their education and training.

Explore Trades

Aerospace

Local, national, and global employment opportunities are soaring for certified Aircraft Maintenance professionals

Collision Repair

Focus on attention to detail and the importance of high-quality repairs while learning from Red Seal-certified instructors and the latest equipment.

Carpentry

Training in carpentry and joinery can help you develop skills to build a career you are proud of.

Culinary

Grow your culinary career in the heart of the Okanagan Valley with programs focusing on a farm-to-table approach, exploring fresh local products.

Electrical

Train to become an Electrician who inspects and tests highly sensitive electrical systems.

Motor Vehicle Trades

Drive the direction of your career with studies in Heavy Mechanical, Automotive Service and Recreation Vehicle Service programs.

Mechanical Building Trades

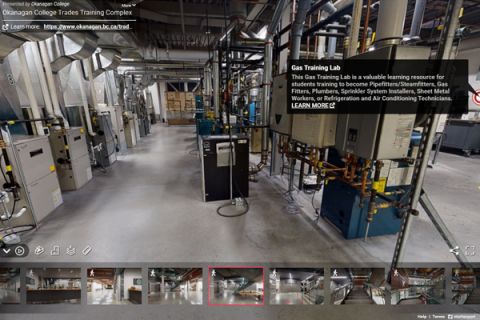

This department focuses on maintenance, testing and operation of all heating, ventilation and air conditioning systems, the distribution of steam, water systems including fire prevention sprinklers, natural gas or propane systems and building plumbing systems.

Welding

Spark your skills by learning a variety of welding processes and using specialized equipment to create a solid bond between metal plate and/or pipe.

Women in Trades Training

Gain confidence to pursue career goals in trades through exploratory programs, sponsorship and additional support in a training centre with a reputation for excellence.

Trades Continuing Studies

Expand your employment opportunities by advertising your skills with certificates.

| Industry Training | General Interest |

| Corporate Training | Culinary Workshops |

Trades Sampler Programs

Trades Sampler programs are ideal for learning practical skills, gain general employment certifications and explore a variety of trades.

Apprentice Hiring Project

Okanagan College Apprentice Hiring Project received over $3 million in funding and will be using that money to support small and medium sized enterprises who hire first-year apprentices, helping the businesses offset costs that come with onboarding new skilled workers.

The project is funded by the Government of Canada’s Apprenticeship Service.

Sub-agreements are due by March 15 2024, no agreements will be accepted after that date.

Employer and Apprentice Registration form must be sumbitted prior to March 28 2024.

Trades Entrance Assessment (TEA)

The Trades Entrance Assessment is designed to provide an alternative entrance option for applicants who may not have met the required Math and/or English entrance requirements for a foundation program within the allowable time frame or cannot provide official documentation proving such. You must apply for a Trades Foundation Program and receive a response from Admission before you can register for this assessment.

Set yourself up for success!

The Trades Success Centre can assist you with preparing for the Trades Entrance Exam (TEA). Whether you have been out of high school a few years, are making a career change or have never attended post-secondary education, we can help set you up for success!

Get prepared to write the TEA by contacting Trades Success Centre Coordinator, Elke Pritchard, by email at epritchard@okanagan.bc.ca.

Learn more about Success Centres here.

Trades Frequently Asked Questions

Click on "Read Trades FAQ" for a list of commonly asked questions from trades students to help prepare yourself for training.

Trades in the news

Events

Useful links

Experience

Join an info session or become a student for a day.

Ask

Have your questions answered by an advisor or recruiter.

Apply

Take the next step and enrol in a program or course at OC.